-

Category: Environment

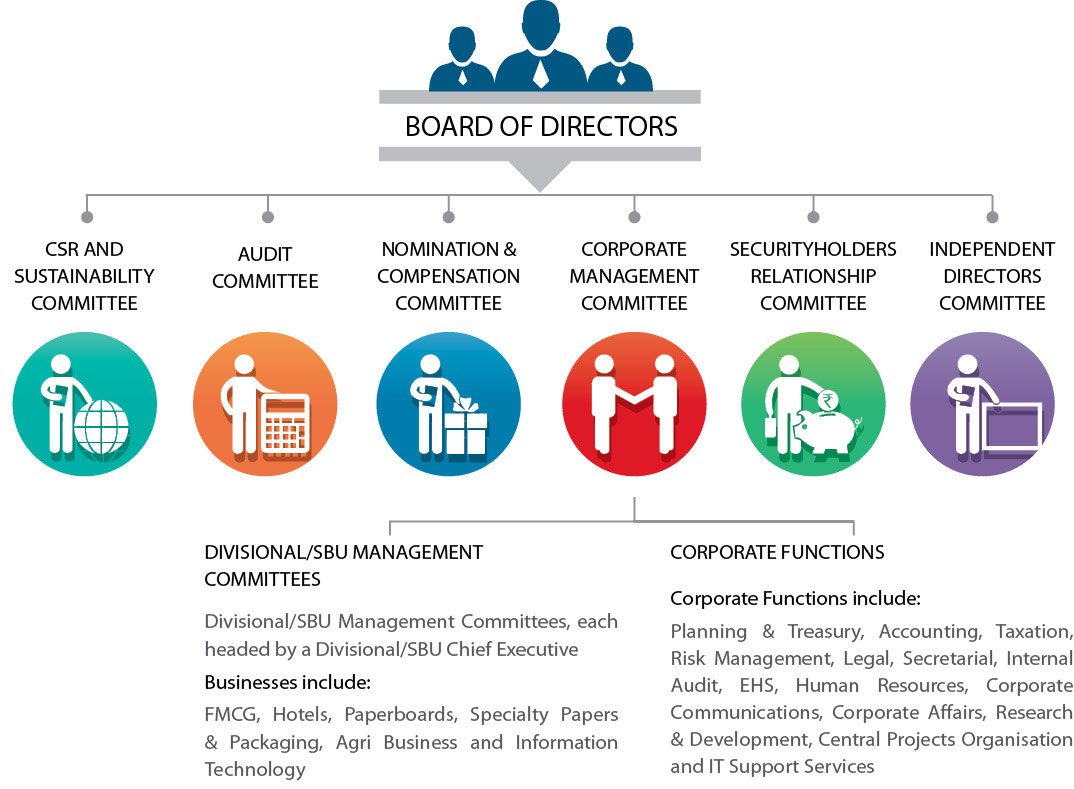

The Company's Corporate Governance processes are designed to support effective management of multiple businesses while retaining focus on each one of them. The practice of Corporate Governance at ITC takes place at three interlinked levels.

| Strategic supervision | by the Board of Directors (Board) |

| Strategic management | by the Corporate Management Committee (CMC) |

| Executive management | by the Divisional / Strategic Business Unit (SBU) Chief Executive assisted by the respective Divisional / SBU Management Committee |

The role, powers and composition of the Board, Board Committees, CMC and Divisional / SBU Management Committees are available on the Company's corporate website.

The ITC Board is a balanced Board comprising Executive Directors and Non-Executive Directors, including Independent Directors.

The Nomination & Compensation Committee of the Board approved the criteria for determining qualifications, positive attributes and independence of Directors as required under the Companies Act, 2013 and the Rules thereunder. The Governance Policy of the Company also inter alia requires that Non-Executive Directors, including Independent Directors, be drawn from amongst eminent professionals with experience in business / finance / law / public administration & enterprises. The Board Diversity Policy of the Company requires the Board to have balance of skills, experience and diversity of perspectives appropriate to the Company. The Articles of Association of the Company provide that the strength of the Board shall not be fewer than five nor more than eighteen.

Directors are appointed / re-appointed with the approval of the Shareholders for a period of three to five years or a shorter duration, in accordance with retirement guidelines as determined by the Board from time to time. The initial appointment of Executive Directors is normally for a period of three years. All Directors, other than Independent Directors, are liable to retire by rotation unless otherwise approved by the Shareholders or provided under any statute.

The Independent Directors have confirmed that they meet the criteria of 'Independence' as stipulated under the statute.

The strength of the Board as on 31st March, 2015, was sixteen, of which four were Executive Directors and eight Independent Directors. The composition of the Board, including other Directorship / Committee membership of Directors was as follows:

| Director | No. of other Directorship(s) 1 | No. of Membership(s) [including Chairmanship(s)] of Board Committees of other companies 2 |

|---|---|---|

| Executive Directors | ||

| Y. C. Deveshwar | 1 | Nil |

| N. Anand | 8 | Nil |

| P. V. Dhobale | Nil | Nil |

| K. N. Grant | 2 | Nil |

| Non-Executive Directors - Independent Directors | ||

| A. Baijal | 5 | 2 [as Chairman] |

| S. Banerjee | Nil | Nil |

| A. Duggal | 5 | 3 [including 1 as Chairman] |

| S. H. Khan | 7 | 9 [including 4 as Chairman] |

| S. B. Mathur | 12 | 5 |

| P. B. Ramanujam | Nil | Nil |

| S. S. H. Rehman | Nil | Nil |

| M. Shankar (Ms.) | 1 | Nil |

| Non-Executive Directors - Others | ||

| A. V. Girija Kumar | Nil | Nil |

| R. E. Lerwill | Nil | Nil |

| S. B. Mainak | 6 | Nil |

| K. Vaidyanath | Nil | Nil |

1. Excludes Directorship in Foreign Companies and Membership of Managing Committees of Chambers of Commerce / Professional Bodies.

2. Denotes Membership / Chairmanship of Audit Committee and / or Stakeholders Relationship Committee of Indian Public Limited Companies.

ITC's Governance Policy requires the Board to meet at least six times in a year. During the year, seven meetings of the Board were held.

Currently, there are five Board Committees - the CSR and Sustainability Committee, the Audit Committee, the Nomination & Compensation Committee, the Securityholders Relationship Committee and the Independent Directors Committee.

The CSR and Sustainability Committee presently comprises the Chairman of the Company and four Non-Executive Directors, one of whom is an Independent Director. The Chairman of the Company is the Chairman of the Committee.

The CSR and Sustainability Committee, inter alia, reviews, monitors and provides strategic direction to the Company's CSR and sustainability practices towards fulfilling its Triple Bottom Line objectives. The Committee seeks to guide the Company in integrating its social and environmental objectives with its business strategies and assists in crafting unique models to support creation of sustainable livelihoods. The Committee formulates & monitors the CSR Policy and recommends to the Board the annual CSR Plan of the Company in terms of the statute. The Committee also reviews the Business Responsibility Report of the Company.

The CMC has constituted a Sustainability Compliance Review Committee, which presently comprises eight members - an Executive Director, two CMC members and five senior members of management. The role of the Committee, inter alia, includes monitoring and evaluating compliance with the Sustainability Policies of the Company and placing a quarterly report thereon for review by the CMC.

The Audit Committee presently comprises five Non-Executive Directors, four of whom are Independent Directors. The Chairman of the Committee is an Independent Director. The Executive Director representing the Finance function, the Chief Financial Officer, the Head of Internal Audit and the representative of the Statutory Auditors are Invitees to meetings of the Audit Committee. The Head of Internal Audit, who reports to the Audit Committee, is the Co-ordinator, and the Company Secretary is the Secretary to the Committee. The representatives of the Cost Auditors are invited to meetings of the Audit Committee whenever matters relating to cost audit are considered.

The Nomination & Compensation Committee presently comprises the Chairman of the Company and five Non-Executive Directors, four of whom are Independent Directors. The Chairman of the Committee is an Independent Director.

The Securityholders Relationship Committee presently comprises four Directors. The Chairman of the Committee is a Non-Executive Director.

The Independent Directors Committee comprises all Independent Directors of the Company.

Note: Further details of the Board Committees are available in the 'Report on Corporate Governance' section of ITC's Report & Accounts 2015.

The Chairman is the Chief Executive of the Company. He is the Chairman of the Board and the CMC. His primary role is to provide leadership to the Board and the CMC for realising Company goals in accordance with the charter approved by the Board.

ITC has a diversified business portfolio, which demands that the senior leadership has an in-depth knowledge and understanding of the functioning of the Company, so as to enhance the value-generating capacity of the organisation and contribute significantly to stakeholders' aspirations and societal expectations. The Chief Executive Officer of the Company is therefore generally chosen from amongst the executive management of the Company. The current Chief Executive Officer of the Company is also the Chairman of the Board.

In terms of the ITC Code of Conduct, Directors, senior management and employees must avoid situations in which their personal interests could conflict with the interests of the Company. This is an area in which it is impossible to provide comprehensive guidance but the guiding principle is that conflicts, if any, or potential conflicts, must be disclosed to higher management for guidance and action as appropriate.

The Directors and key executives are required to disclose to the Board whether they, directly or indirectly or on behalf of third parties, have material interest in any transaction or matter directly affecting the Company. Senior management is required to confirm on an annual basis that no material transaction has been entered into by them which could have potential conflict with the interests of the Company at large; such confirmations are placed before the Board. All transactions of the Company with related parties, or their subsequent modifications, are required to be approved by the Audit Committee. Further, transactions with related parties which are not in the ordinary course of business or not on arm's length basis would also require the approval of the Board or Shareholders, as applicable.

The Company has a code of conduct for prevention of insider trading in the securities of the Company. The ITC Code of Conduct for Prevention of Insider Trading - 2015, inter alia, prohibits purchase or sale of securities of the Company by Directors and employees while in possession of unpublished price sensitive information in relation to the Company.

ITC believes that a Board, which is well informed / familiarised with the Company, can contribute significantly to effectively discharge its role of trusteeship in a manner that fulfils stakeholders' aspirations and societal expectations. In pursuit of this, the Directors are updated on a continuing basis on changes / developments in the domestic / global corporate and industry scenario including those pertaining to statutes / legislations and economic environment, to enable them to take well informed and timely decisions. The Directors are also kept abreast on all business related matters, risk assessment & minimisation procedures, and new initiatives proposed by the Company.

The Nomination & Compensation Committee has approved the Policy on Board evaluation, evaluation of Board Committees' functioning and individual Director evaluation. In keeping with ITC's belief that it is the collective effectiveness of the Board that impacts Company performance, the primary evaluation platform is that of collective performance of the Board as a whole. Board performance is assessed against the roles and responsibilities of the Board as provided in the statute read with the Company's Governance Policy. The parameters for Board performance evaluation have been derived from the Board's core role of trusteeship to protect and enhance shareholder value as well as fulfil expectations of other stakeholders through strategic supervision of the Company. Evaluation of functioning of Board Committees is based on discussions amongst Committee members and shared by each Committee Chairman with the Board. Individual Directors are evaluated in the context of the role played by each Director as a member of the Board at its meetings, in assisting the Board in realising its role of strategic supervision of the functioning of the Company in pursuit of its purpose and goals.

The Board determines the remuneration of the Chairman and other Executive Directors, on the recommendation of the Nomination & Compensation Committee; remuneration of the Directors is subject to the approval of the shareholders. Such remuneration is linked to the performance of the Company inasmuch as the performance bonus of Executive Directors is based on various qualitative and quantitative performance criteria. Such criteria also includes the Company's contribution with respect to sustainable development of the society / nation & social investments and sensitivity to environment.

Remuneration to Non-Executive Directors is by way of commission for each financial year; such commission is determined by the Board within the limit approved by the shareholders. Their remuneration is based, inter alia, on Company performance and regulatory provisions and is payable on a uniform basis to reinforce the principle of collective responsibility. Non-Executive Directors are also entitled to sitting fees for attending meetings of the Board and Committees thereof, the quantum of which is determined by the Board.

ITC's remuneration strategy is market - led, leverages performance and takes into account the Company's capacity to pay. The remuneration package is competitive and is designed to attract and retain quality talent.

The ratio of remuneration of the highest paid employee to the median remuneration for the year 2014-15 was 439:1. The ratio of the annual increase (percentage) in Total Compensation of the highest paid employee to the median annual increase (percentage) in Total Compensation of all employees (excluding the highest paid employee) was 23:14 in FY 2014-15.

Remuneration includes salary, performance bonus, allowances & other benefits/ applicable perquisites except contribution to the approved Group Pension under the defined benefit scheme and Gratuity Funds and provisions for leave encashment which are actuarially determined on an overall Company basis. The term 'remuneration' has the meaning assigned to it under the Companies Act, 2013. Stock Options have been granted to the Directors and Employees under the Employee Stock Option Schemes of the Company at 'market price' [within the meaning of the erstwhile SEBI (Employee Stock Option Scheme and Employee Stock Purchase Scheme) Guidelines, 1999]. The Company has not incurred any expenditure for this purpose which can be ascribed to any Director or Employee.

ITC believes that every employee is a trustee of its stakeholders and must strictly adhere to a Code of Conduct and conduct himself/herself at all times in a professional and ethical manner. Integrity is a core value and forms the basis of the Company's organisation culture.

ITC's Code of Conduct, has been in place since 1996. The Code is anchored in three core principles - good corporate governance, good corporate citizenship and exemplary personal conduct in relation to the Company's business and reputation. The Code clearly spells out guidelines for employees on dealing with people in the organisation, ensuring a gender friendly workplace, relationships with suppliers and customers, legal compliance, health & safety, avoidance of conflict of interest, transparency and auditability in all their actions, protection of confidential information, leading by example etc.

The ITC Code of Conduct is displayed on the Company's corporate website and is shared with employees at the time of their induction into the Company. A system has also been put in place to get employees to read and sign-off ITC's Sustainability Policies and the ITC Code of Conduct. Any violation of the ITC Code of Conduct by an employee renders him/her liable for disciplinary action.

ITC's Code of Conduct specifically states that in the context of possible or potential areas of conflict of interest, such incidents must be disclosed immediately to higher management for guidance and action as appropriate.

A Whistleblower Policy is in place and has been displayed on the Company's corporate website and has also been appropriately communicated to all employees.

As a diversified enterprise, ITC continues to focus on a system-based approach to business risk management. The management of risk is embedded in the corporate strategies of developing a portfolio of world-class businesses that best match organisational capability with market opportunities, focusing on building distributed leadership and succession planning processes, nurturing specialism and enhancing organisational capabilities through timely developmental inputs. Accordingly, management of risk has always been an integral part of the Company's 'Strategy of Organisation' and straddles its planning, execution and reporting processes and systems. Backed by strong internal control systems, the current Risk Management Framework consists of the following key elements:

The combination of policies and processes as outlined above adequately addresses the various risks associated with the Company's businesses.

The Company also constituted a Risk Management Committee during the year.